Cash Flow and Budgeting Analysis

Cash flow and budgeting analysis offer several key benefits to individuals and businesses alike. Firstly, cash flow analysis provides a clear picture of liquidity, ensuring there’s enough cash to cover immediate expenses and investments. Read more »

Financial and Retirement Planning

Our Financial and retirement planning offers numerous benefits that contribute to long-term financial security and peace of mind. Firstly, it provides a structured approach to managing income, expenses, and investments, helping individuals align their financial goals with practical strategies. Read more »

Debt and Finance Advising

Debt and finance advising offers a myriad of benefits to individuals and businesses alike. Firstly, it provides tailored strategies to manage and reduce debt effectively. These advisors analyze financial situations comprehensively, considering income, expenses, and existing debts to craft personalized plans for debt repayment. Read more »

International Taxation

Self-Directed Individual Retirement Account

A Self-Directed Individual Retirement Account (SDIRA) is a type of individual retirement account that provides investors with greater control over their investment choices compared to traditional IRAs. Read more »

Mergers, Acquisitions, and Sales

Financial Projections and Forecasts

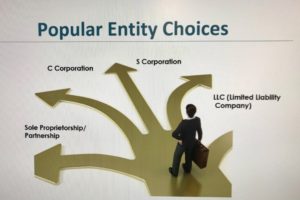

Entity Selection and Restructuring

Entity selection involves choosing the appropriate legal structure for a business, considering factors such as liability protection, tax implications, and ownership structure. Common entity types include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, each offering different benefits and drawbacks. Read more »

Business Valuation

Business valuation is a critical process used to determine the economic worth of a business or company. It plays a central role in a variety of business contexts, including mergers and acquisitions, selling or buying a business, obtaining financing, estate planning, and resolving disputes. Read more »

Bookkeeping & Payroll

Bookkeeping and payroll management play pivotal roles in tax minimization strategies for businesses. Accurate bookkeeping ensures that all financial transactions are meticulously recorded and categorized, laying the groundwork for identifying deductible expenses and maximizing tax deductions. Read more »