Cash flow and budgeting analysis offer several key benefits to individuals and businesses alike. Firstly, cash flow analysis provides a clear picture of liquidity, ensuring there’s enough cash to cover immediate expenses and investments.

Cash flow and budgeting analysis offer several key benefits to individuals and businesses alike. Firstly, cash flow analysis provides a clear picture of liquidity, ensuring there’s enough cash to cover immediate expenses and investments.

Our Financial and retirement planning offers numerous benefits that contribute to long-term financial security and peace of mind. Firstly, it provides a structured approach to managing income, expenses, and investments, helping individuals align their financial goals with practical strategies.

Debt and finance advising offers a myriad of benefits to individuals and businesses alike. Firstly, it provides tailored strategies to manage and reduce debt effectively. These advisors analyze financial situations comprehensively, considering income, expenses, and existing debts to craft personalized plans for debt repayment.

International taxation encompasses the intricate framework of rules and principles governing the taxation of individuals and businesses engaged in cross-border activities.

A Self-Directed Individual Retirement Account (SDIRA) is a type of individual retirement account that provides investors with greater control over their investment choices compared to traditional IRAs.

Mergers, acquisitions, and sales are fundamental strategies in the business world, often pursued to drive growth, gain market share, or streamline operations. Mergers occur when two companies consolidate their operations to form a single entity, pooling resources, talent, and expertise. This process typically involves negotiations between the involved parties to determine ownership stakes, management structure, Read More »

Financial projections and forecasts serve as indispensable tools for companies to chart their course and navigate the complex landscape of business operations. These projections provide a glimpse into the future financial health of the organization, allowing management to anticipate potential challenges and capitalize on emerging opportunities. By analyzing historical data, market trends, and industry benchmarks, Read More »

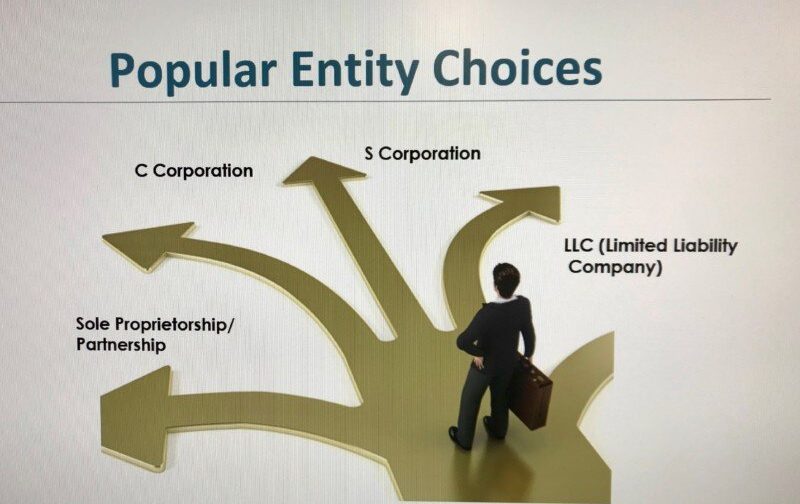

Entity selection involves choosing the appropriate legal structure for a business, considering factors such as liability protection, tax implications, and ownership structure. Common entity types include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, each offering different benefits and drawbacks.

Business valuation is a critical process used to determine the economic worth of a business or company. It plays a central role in a variety of business contexts, including mergers and acquisitions, selling or buying a business, obtaining financing, estate planning, and resolving disputes.

Bookkeeping and payroll management play pivotal roles in tax minimization strategies for businesses. Accurate bookkeeping ensures that all financial transactions are meticulously recorded and categorized, laying the groundwork for identifying deductible expenses and maximizing tax deductions.